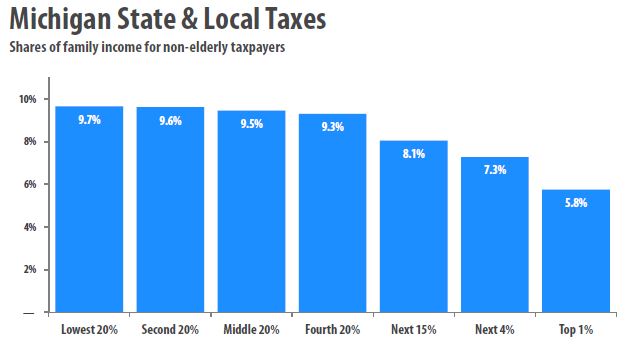

Michigan has a fairly regressive tax rate. According to data from The Institute on Taxation and Economic Policy (ITEP), the bottom 80% of Michiganders pay almost 10% of their income in taxes while the top 20% only pay about 7% of their income in taxes. This occurs in part because of our state’s reliance on the sales tax. ITEP’s Who Pays report notes that “because sales taxes are levied at a flat rate, and because spending as a share of income falls as income rises, sales taxes inevitably take a larger share of income from low- and middle-income families than they take from the rich.” Since Michigan is just one of a handful of states with a flat income tax, this inequity is not made up when taxpayers pay their state taxes.

Governor Snyder’s plan to fix Michigan roads would add to the burden of the poor and middle class. Snyder plans to add 19 cents onto the gasoline tax and increase vehicle registration fees by 60%. It is hard to be in favor of new taxes such as these that would add to the poor and middle classes tax burden when the wealthy have been given tax breaks under the Snyder regime. Take for instance his 1.8 billion dollar tax cut on business that allowed rich business owners like those that own Biggby Coffee to pay less in taxes.

If Governor Snyder wants additional money to fix the roads, he has some good options. He can spend some of Michigan’s healthy rainy day fund, or he can reinstate the business tax for businesses who have a net profit of over say $200,000. Michiganders should reject any new regressive tax increases. The poor and the middle class are already paying more than their fair share.

Note: The Institute on Taxation and Economic Policy favors a gas tax fix roads. However, they believe the tax should be offset with a tax credit for the poor. The problem in Michigan is that Governor Snyder has been reducing or eliminating such tax credits rather than increasing them.